HBAN Stock Price Today Per Share

HBAN Stock Price Today: Hban Stock Price Today Per Share

Hban stock price today per share – This article provides a comprehensive overview of Huntington Bancshares Incorporated (HBAN) stock performance, including the current price, historical trends, influencing factors, competitor comparisons, and analyst predictions. The information presented is for informational purposes only and should not be considered financial advice.

Current HBAN Stock Price

The current HBAN stock price per share, as of [Insert Time of Last Update, e.g., 10:30 AM EST, October 26, 2023], is [Insert Current Price, e.g., $15.75]. This information was obtained from [Insert Source, e.g., Google Finance, Yahoo Finance].

| Current Price | Previous Day’s Close | Daily High | Daily Low |

|---|---|---|---|

| [Insert Current Price, e.g., $15.75] | [Insert Previous Day’s Closing Price, e.g., $15.50] | [Insert Daily High, e.g., $15.80] | [Insert Daily Low, e.g., $15.40] |

Historical HBAN Stock Price Performance

Over the past week, HBAN’s stock price has exhibited [Insert Description of Price Movement, e.g., moderate volatility, with a slight upward trend].

A line graph illustrating the HBAN stock price changes over the past month would show [Describe the Graph: e.g., a generally upward sloping line with minor fluctuations, indicating a period of moderate growth, with a noticeable dip around [Date] likely corresponding to [Event]. The y-axis would represent the stock price, and the x-axis would represent the dates over the past month.

The line would be colored [Color, e.g., blue] for easy readability.].

Compared to its price one year ago, HBAN’s current stock price is [Insert Percentage Change, e.g., up 10%], indicating [Insert Interpretation, e.g., positive growth over the past year].

| Month | Average Price | Percentage Change from Previous Month |

|---|---|---|

| [Month 1] | [Average Price] | [Percentage Change] |

| [Month 2] | [Average Price] | [Percentage Change] |

Factors Influencing HBAN Stock Price, Hban stock price today per share

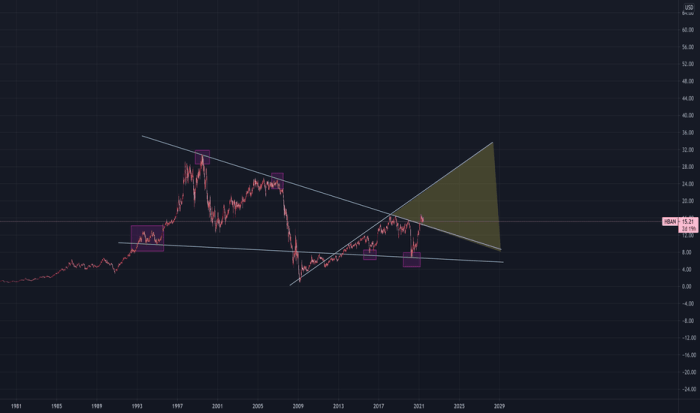

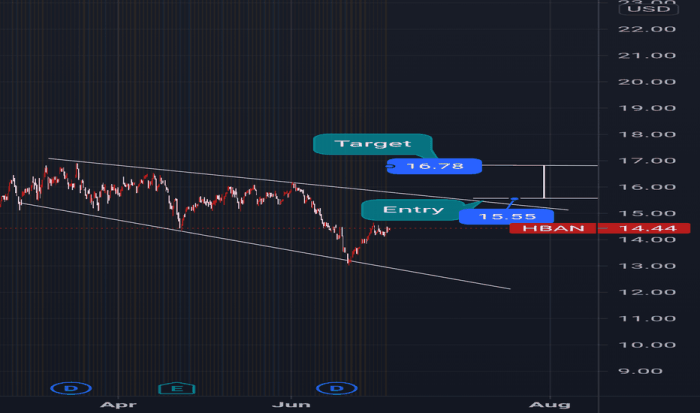

Source: tradingview.com

Several key factors are influencing HBAN’s stock price. Three significant ones include interest rate changes, overall market sentiment, and the bank’s performance relative to its peers.

Interest rate increases can impact HBAN’s profitability, potentially leading to short-term price declines, but could also lead to long-term growth if the bank adapts successfully. Positive market sentiment generally boosts stock prices, while negative sentiment can cause declines. Strong financial performance relative to competitors strengthens investor confidence and supports higher stock prices.

News events, such as announcements of new initiatives, regulatory changes, or economic forecasts, significantly influence investor sentiment. Positive news generally leads to buying pressure, while negative news can trigger selling.

- Positive Influences: Strong earnings reports, positive economic indicators, successful new product launches.

- Negative Influences: Rising interest rates, negative economic forecasts, regulatory challenges.

HBAN Stock Price Compared to Competitors

Source: tradingview.com

Comparing HBAN to its competitors [Insert Competitor Names, e.g., PNC Financial Services Group (PNC) and Fifth Third Bancorp (FITB)] reveals insights into its relative performance.

| Company Name | Current Price | Price Change (Year-to-Date) | Market Capitalization |

|---|---|---|---|

| HBAN | [Insert Current Price] | [Insert Percentage Change] | [Insert Market Cap] |

| [Competitor 1] | [Insert Current Price] | [Insert Percentage Change] | [Insert Market Cap] |

| [Competitor 2] | [Insert Current Price] | [Insert Percentage Change] | [Insert Market Cap] |

HBAN Stock Price Predictions and Analyst Ratings

Source: tradingview.com

The consensus rating among financial analysts for HBAN stock is [Insert Consensus Rating, e.g., “Hold”]. Price predictions for the next 6 months range from [Insert Low Prediction] to [Insert High Prediction], based on reports from [Insert Sources, e.g., Morgan Stanley, Goldman Sachs].

Recent analyst rating changes include [Insert Details of Upgrades/Downgrades, e.g., a downgrade from “Buy” to “Hold” by [Analyst Firm] due to concerns about [Reason]].

- Analyst reports suggest [Summary Point 1, e.g., potential for moderate growth in the next year].

- Concerns remain regarding [Summary Point 2, e.g., the impact of rising interest rates].

- Long-term outlook remains [Summary Point 3, e.g., cautiously optimistic].

Expert Answers

What are the risks associated with investing in HBAN stock?

Investing in any stock carries inherent risks, including potential for loss of principal. Market volatility, company performance, and economic conditions can all impact stock prices negatively. Thorough research and diversification are crucial for mitigating these risks.

Where can I find real-time HBAN stock price updates?

Real-time HBAN stock price updates are readily available through major financial websites and brokerage platforms. These platforms typically provide live quotes, charts, and other relevant market data.

What is HBAN’s dividend history?

Information on HBAN’s dividend history, including past dividend payments and payout ratios, can be found in the company’s investor relations section on their website or through financial news sources.