JCP Stock Price Chart A Comprehensive Analysis

JCP Stock Price Chart Analysis

Jcp stock price chart – This analysis delves into the historical trends, influencing factors, and potential future trajectory of JCPenney’s (JCP) stock price. We will explore both technical and fundamental aspects, providing insights for investors with varying risk tolerances.

JCP Stock Price Historical Trends

Source: perkins.org

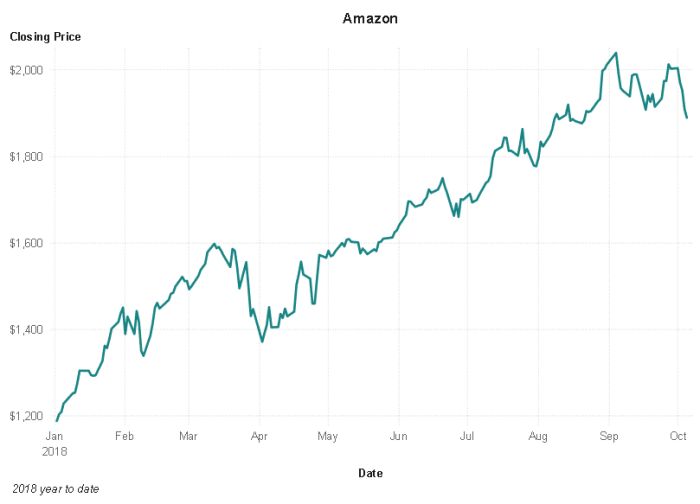

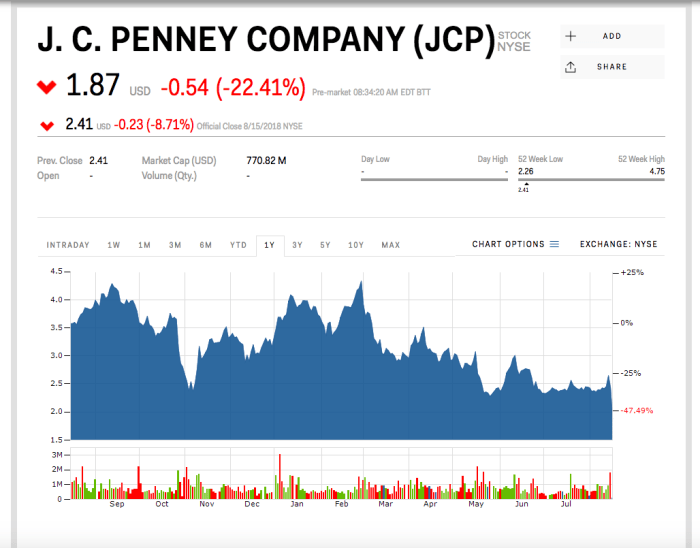

Over the past five years, JCP stock has experienced significant volatility, reflecting the challenges faced by the company within a rapidly evolving retail landscape. The stock price has shown periods of both substantial gains and considerable losses. Pinpointing exact highs and lows requires referencing specific historical data, but a general downward trend is observable with intermittent rallies.

Periods of heightened volatility often coincided with announcements regarding financial performance, restructuring efforts, and broader macroeconomic shifts. For example, periods of economic uncertainty or changes in consumer spending habits directly impacted JCP’s performance and consequently, its stock price.

Compared to its retail competitors, JCP’s performance has generally lagged behind. While specific competitor performance varies greatly, many established retail giants have shown greater resilience and growth in the same period.

| Company Name | Stock Symbol | 5-Year High | 5-Year Low |

|---|---|---|---|

| JCPenney | JCP | (Insert Historical High) | (Insert Historical Low) |

| Competitor 1 | (Symbol) | (Insert Historical High) | (Insert Historical Low) |

| Competitor 2 | (Symbol) | (Insert Historical High) | (Insert Historical Low) |

Factors Influencing JCP Stock Price, Jcp stock price chart

Several factors significantly influence JCP’s stock price. These factors can be broadly categorized into macroeconomic conditions, company-specific events, and investor sentiment.

Macroeconomic factors such as inflation and interest rate changes directly affect consumer spending and the overall economic climate. High inflation can reduce consumer disposable income, impacting JCP’s sales. Similarly, rising interest rates can increase borrowing costs for the company and decrease investor appetite for riskier assets.

Analyzing the JCP stock price chart requires considering various market factors. For a comparative perspective, it’s helpful to look at the performance of other companies; for instance, you might want to check the current value by looking at the ilmn stock price today per share to understand broader market trends. Returning to JCP, understanding its historical volatility is key to predicting future price movements.

Company-specific events, including earnings reports, new product launches, and management changes, also play a crucial role. Positive earnings surprises generally lead to price increases, while disappointing results often trigger sell-offs. Similarly, successful product launches can boost investor confidence, whereas management changes can create uncertainty.

Investor sentiment and market speculation are powerful forces shaping JCP’s stock price. Negative news coverage or analyst downgrades can trigger sell-offs, even if the underlying fundamentals haven’t significantly changed. Conversely, positive news or strong buy recommendations can lead to price increases driven by speculation and herd behavior. For example, a rumor of a potential acquisition could temporarily inflate the stock price.

Technical Analysis of JCP Stock Price Chart

Source: businessinsider.com

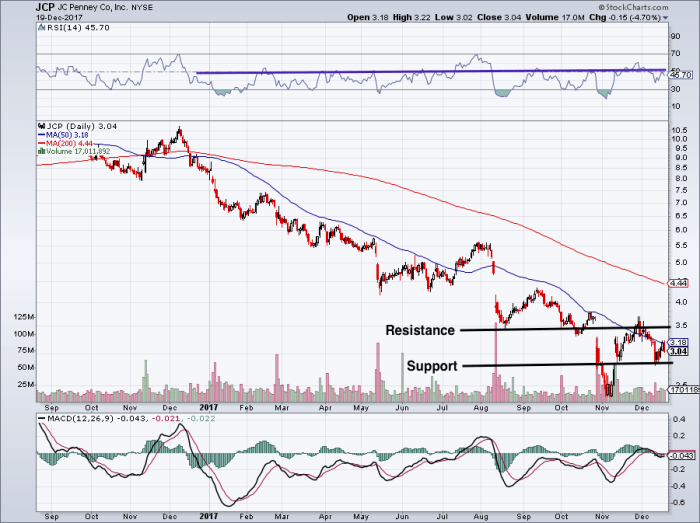

Technical analysis of the JCP stock price chart involves identifying key support and resistance levels, analyzing moving averages, and recognizing chart patterns to predict future price movements. Support levels represent price points where buying pressure is expected to outweigh selling pressure, preventing further declines. Resistance levels are the opposite, indicating where selling pressure might overcome buying pressure, halting price increases.

Moving averages, such as the 50-day and 200-day moving averages, smooth out price fluctuations and provide insights into the overall trend. A 50-day moving average above the 200-day moving average is often considered a bullish signal, suggesting an upward trend. The reverse indicates a bearish trend.

Notable chart patterns, such as head and shoulders or double tops/bottoms, can provide further clues about potential price reversals. A head and shoulders pattern, for example, is often interpreted as a bearish reversal signal, suggesting a potential downward trend after a period of price increase.

Fundamental Analysis of JCP’s Financial Performance

Source: investorplace.com

A fundamental analysis examines JCP’s financial health and performance to assess its intrinsic value. This involves analyzing revenue, profit margins, debt levels, and competitive positioning.

- Revenue Growth: Analyze JCP’s revenue trends over the past few years to determine whether it’s experiencing growth or decline. This will provide insight into the company’s ability to generate sales.

- Profit Margins: Examine JCP’s gross and net profit margins to assess its profitability and efficiency. Declining margins might indicate increased competition or rising costs.

- Debt Levels: Evaluate JCP’s debt-to-equity ratio and other debt metrics to determine its financial leverage and risk. High debt levels can increase financial vulnerability.

- Competitive Position: Assess JCP’s market share, brand recognition, and competitive advantages within the retail industry. A strong competitive position is crucial for long-term success.

- Business Strategies: Evaluate the effectiveness of JCP’s strategies, such as its omnichannel approach, marketing efforts, and cost-cutting measures. Successful strategies should translate into improved financial performance.

JCP Stock Price Prediction and Future Outlook

Predicting JCP’s stock price with certainty is impossible. However, considering various factors, several scenarios are plausible. A positive scenario could involve improved financial performance, successful strategic initiatives, and positive investor sentiment, leading to a price increase. Conversely, a negative scenario could include continued financial struggles, increased competition, and negative market sentiment, resulting in further price declines.

A hypothetical investment strategy for JCP stock would depend on risk tolerance. Conservative investors might adopt a “buy and hold” approach, while more aggressive investors might consider options trading or leveraged investments. However, it’s crucial to remember that JCP is a high-risk investment.

| Risk Tolerance | Investment Strategy | Potential Returns | Potential Risks |

|---|---|---|---|

| Low | Buy and hold small positions | Low to moderate | Limited upside, potential for losses |

| Medium | Diversified portfolio with moderate JCP allocation | Moderate to high | Moderate risk of losses, potential for significant gains |

| High | Aggressive trading strategies, options | High potential returns | High risk of substantial losses |

Visual Representation of JCP Stock Price Data

A visual representation of JCP’s stock price chart would show the overall trend, volatility, and significant price movements. The chart would likely exhibit periods of both sharp increases and decreases, reflecting the company’s fluctuating performance.

A hypothetical chart showing a significant upward trend would depict a steadily rising price line, punctuated by minor corrections. Key price levels, such as support and resistance points, would be clearly marked. Increased trading volume would accompany periods of sharp price increases, indicating strong buying pressure. Conversely, reduced volume during periods of consolidation would suggest a lack of decisive buying or selling pressure.

A major news event, such as a positive earnings surprise, would be visually represented by a sudden and sharp upward spike in the price line, accompanied by a significant surge in trading volume. This would illustrate the market’s immediate positive reaction to the good news.

Expert Answers: Jcp Stock Price Chart

What are the major risks associated with investing in JCP stock?

Major risks include the company’s high debt levels, dependence on consumer spending, and vulnerability to economic downturns. Competition in the retail sector also presents a significant challenge.

Where can I find real-time JCP stock price data?

Real-time data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

How does inflation impact JCP’s stock price?

High inflation can negatively affect JCP’s stock price by increasing operating costs and potentially reducing consumer spending.

What is JCPenney’s current dividend policy?

You should consult a reliable financial source for the most up-to-date information on JCPenney’s dividend policy as it can change.