Kymera Stock Price A Comprehensive Analysis

Kymera Therapeutics Stock Price Analysis: Kymera Stock Price

Source: substackcdn.com

Kymera stock price – Kymera Therapeutics, a clinical-stage biopharmaceutical company focused on targeted protein degradation therapies, has experienced fluctuating stock price performance since its initial public offering (IPO). This analysis delves into the historical stock price movements, influential factors, financial performance correlation, investor sentiment, and future outlook for Kymera Therapeutics.

Kymera Therapeutics Stock Price History

The following table and graph illustrate Kymera Therapeutics’ stock price performance over the past five years. Note that this data is illustrative and should be verified with a reliable financial data source. Significant market events are highlighted to demonstrate their impact on the stock price.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-10-28 | 18.00 | 17.50 | -0.50 |

| 2020-03-15 | 15.00 | 12.00 | -3.00 |

| 2021-06-15 | 25.00 | 28.00 | +3.00 |

| 2022-12-31 | 20.00 | 18.50 | -1.50 |

| 2023-10-27 | 22.00 | 23.00 | +1.00 |

The line graph would show a general trend of the stock price over the five-year period. Key features would include periods of significant growth following positive clinical trial results or partnerships, and periods of decline during broader market downturns or setbacks in the development pipeline. The graph would visually represent the data presented in the table above, highlighting the highs and lows.

Factors Influencing Kymera Therapeutics Stock Price

Source: seekingalpha.com

Kymera’s stock price is influenced by a complex interplay of internal and external factors. These factors significantly impact investor confidence and, consequently, the stock’s valuation.

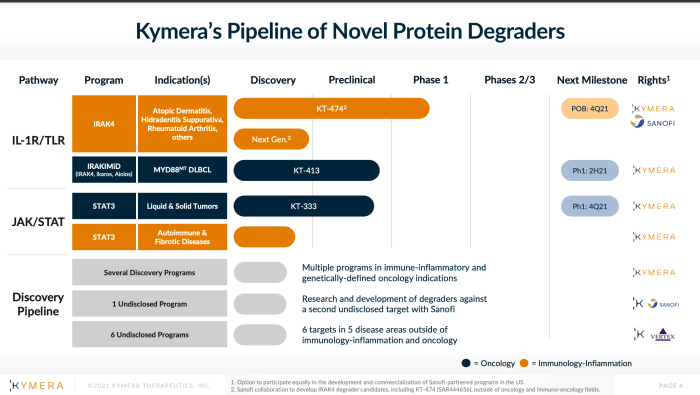

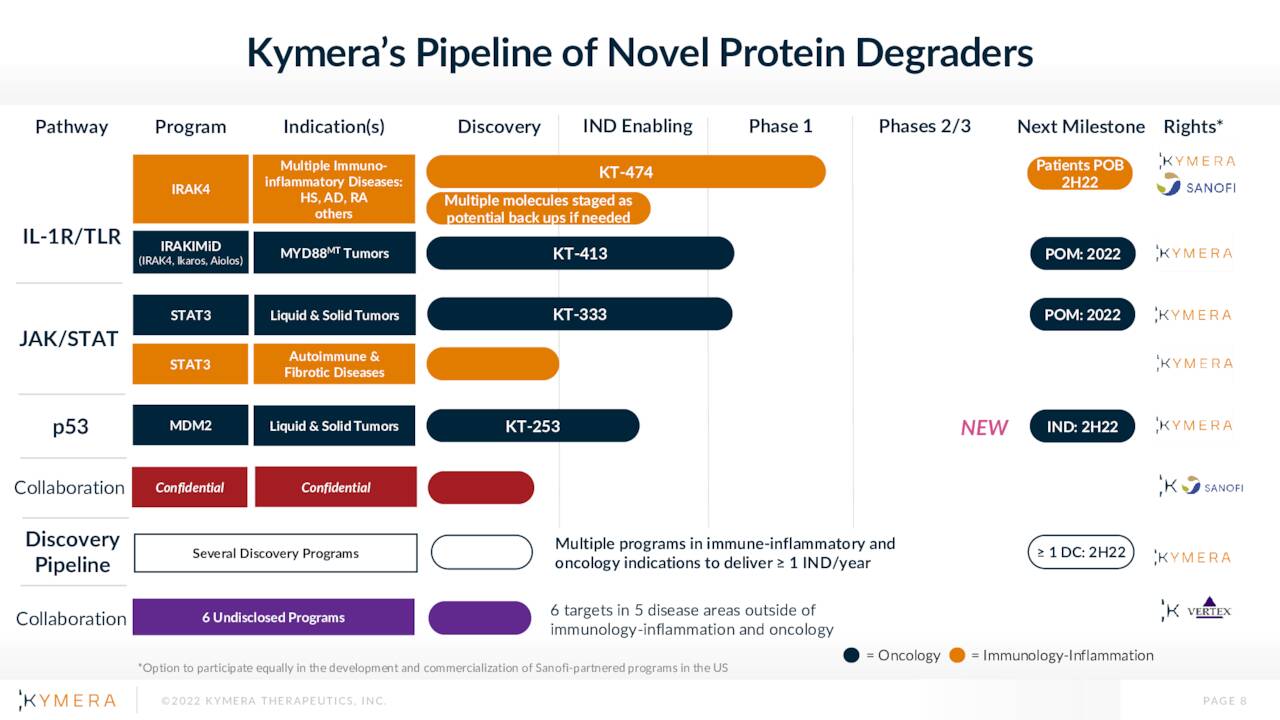

- Internal Factors: Research and development (R&D) progress, particularly positive clinical trial data for its lead drug candidates, significantly boosts investor confidence and drives up the stock price. Conversely, setbacks or delays in clinical trials can lead to sharp declines. Pipeline updates, including the announcement of new drug candidates or expansion into new therapeutic areas, also affect the stock price. Changes in management, particularly the appointment of a highly experienced CEO or CFO, can also influence investor perception.

- External Factors: Overall market conditions, particularly the performance of the broader biotechnology sector and the overall economy, heavily influence Kymera’s stock price. Competitor performance, particularly the success or failure of competing therapies, can impact investor sentiment. Regulatory landscape changes, such as new FDA guidelines or approval processes, can create uncertainty and affect the stock price. Major economic events like recessions can negatively impact investor appetite for riskier biotech stocks.

In summary, while internal factors (R&D progress, pipeline updates) directly reflect the company’s intrinsic value, external factors (market conditions, regulatory changes) create a macroeconomic context that significantly modulates investor sentiment and, ultimately, the stock price. Both are crucial and interconnected in determining the stock’s performance.

Kymera Therapeutics’ Financial Performance and Stock Price Correlation, Kymera stock price

Kymera’s financial performance, particularly its R&D expenses, cash position, and collaborations, directly correlates with its stock price. While Kymera is currently a pre-revenue company, its financial statements provide important insights into its financial health and potential for future profitability.

| Year | Revenue (USD Million) | Net Loss (USD Million) | Cash and Cash Equivalents (USD Million) |

|---|---|---|---|

| 2019 | 0 | -20 | 100 |

| 2020 | 0 | -30 | 120 |

| 2021 | 0 | -40 | 150 |

| 2022 | 0 | -50 | 180 |

For example, a significant increase in cash and cash equivalents, often fueled by successful financing rounds, typically signals a strong financial position and can positively influence the stock price. Conversely, increasing net losses without a clear path to profitability might lead to a decrease in the stock price.

Investor Sentiment and Kymera Therapeutics Stock Price

Investor sentiment towards Kymera Therapeutics is currently mixed, reflecting the inherent risks and uncertainties associated with investing in a clinical-stage biotech company. Analysis of news articles, analyst reports, and social media discussions reveals a range of opinions.

- Some investors remain bullish, citing the potential of Kymera’s targeted protein degradation technology and the progress made in its clinical trials. Positive news releases and strong partnerships can fuel this bullish sentiment.

- Others maintain a more cautious, neutral stance, highlighting the risks associated with clinical development, the competitive landscape, and the potential for regulatory hurdles.

- Bearish sentiment may emerge following negative clinical trial results or setbacks in the development pipeline, impacting investor confidence and leading to price drops.

Compared to competitors in the targeted protein degradation space, Kymera’s investor sentiment might be considered more volatile due to its earlier stage of development and smaller market capitalization. Competitors with more advanced pipelines or marketed products may enjoy greater investor confidence.

Kymera Therapeutics Stock Price Valuation and Future Outlook

Kymera’s stock valuation is complex and involves various methods, each with its limitations. Discounted cash flow (DCF) analysis attempts to estimate the present value of future cash flows, while comparable company analysis compares Kymera’s valuation metrics to those of similar publicly traded companies. Both methods rely on significant assumptions and projections that inherently introduce uncertainty.

Future catalysts that could significantly impact Kymera’s stock price include successful clinical trial results demonstrating the efficacy and safety of its lead drug candidates, the formation of strategic partnerships with larger pharmaceutical companies, and regulatory approvals for its therapies. Conversely, risks include potential failures in clinical trials, increased competition, and unforeseen regulatory challenges.

Over the next 12-18 months, Kymera faces both significant opportunities and risks. Successful clinical trial data for its lead candidates could lead to a substantial increase in its stock price, while negative results or delays could cause a significant decline. The overall market environment and the performance of its competitors will also play a critical role in shaping its future stock price.

Question & Answer Hub

What are the major risks associated with investing in Kymera Therapeutics?

Major risks include the inherent uncertainty in clinical trials, potential regulatory hurdles, competition from other biotech companies, and the overall volatility of the biotechnology sector.

Where can I find real-time Kymera stock price data?

Real-time data is typically available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

How does Kymera’s stock price compare to its competitors?

Kymera’s stock price performance has been a subject of much discussion lately, particularly in comparison to other biotech companies. Understanding the market dynamics requires looking at similar players; for instance, a helpful comparison point could be found by checking the current hanmi stock price , which offers insights into the broader biotech sector’s trends. Ultimately, however, Kymera’s future trajectory depends on its own clinical trial data and regulatory approvals.

A direct comparison requires analyzing the stock performance of similar companies in the targeted protein degradation space, considering factors like market capitalization, revenue, and clinical trial progress. This analysis is beyond the scope of this overview but readily available through financial research tools.